Real wealth is built in bear markets…

The recent crash in the Indian Stock Market has caused a lot of heartburn for retail investors. Investors have lost Rs. 32 lakh crore (USD 25+ Billion) in just 6 sessions. The sentiments seem to have gone down and the markets have been shaky since October 2024.

A few of our Mutual Fund investors reached out to us to inquire about the market volatility. While we addressed all their concerns and queries, we thought that it would be good to write a blog on this topic for the benefit of a wider audience.

Investments in markets are risky – even the Government schemes are not entirely risk-free, theoretically. Risk and Reward go hand-in-hand.

Since direct Equity investments are more risky and volatile, Mutual Fund is considered to be less risky, more diversified means of investing. However, there is risk in Mutual Fund investing as well. You must have read or heard the famous disclaimer from Mutual Funds Sahi Hai campaign which says:

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

However, investors should understand the difference between volatility and risk. Though they are used interchangeably, they are not the same.

Risk relates to the probability of losing your investment/capital. Volatility pertains to up and down movements in the market because of several factors.

Markets are meant to be volatile. The only investment that continuously grows (though at a very tepid rate) is a Fixed Deposit. There is no volatility. But you know the kind of returns an FD gives. You wouldn’t be reading this blog if you were satisfied with your FD returns.

What investors, especially retail investors, should remember is how the power of compounding works. It is time-in-the-market and not timing-the-market that helps create wealth in the long run.

Such market downfalls, crashes etc. are a blip, a distraction in the long-term trajectory of the markets. This is more true in the Indian context where the next few decades are going to offer immense growth opportunities for all market participants.

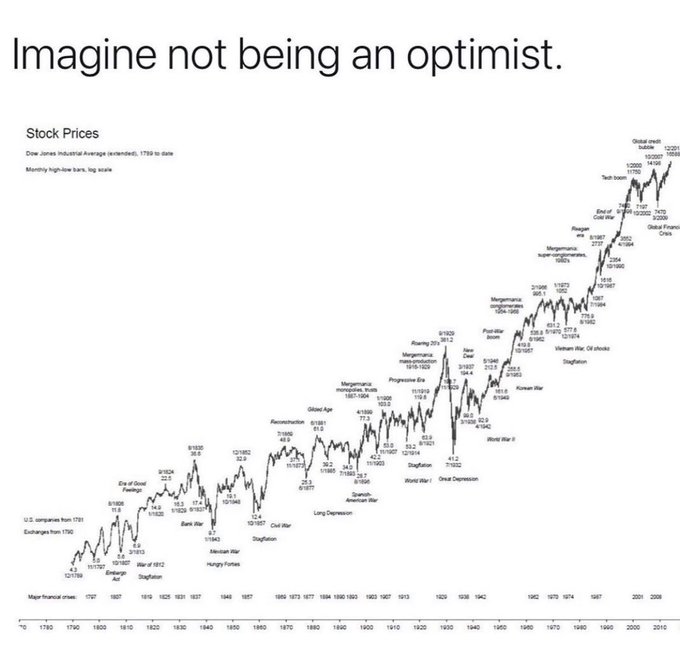

Here is an example which highlights the importance of zooming out and thinking long-term.

There have been several ups and downs, at times of significant magnitude, during the course of the overall trajectory. Sitting at a particular point and keeping a narrow, short-sighted view, one could have been a pessimist and exited the market at several points. As the headline appropriately mentions: Imagine not being an optimist in this overall journey! You would have lost significant wealth-creation opportunities, without doing anything flashy or extraordinary.

Remember: Real wealth is built in bear markets!In his bestseller book Atomic Habits the author James Clear has an iconic quote “You do not rise to the level of your goals, you fall to the level of your systems.“

Trust your system and be optimistic!

The system we have chosen is to continue investing systematically (does SIP ring a bell?) irrespective of market trends.

So continue SIPs and stay put in the market along with us!

~ Truff Partners